Where do the largest SaaS companies get their website traffic from?

Where are the SaaS 100 advertising?

As a B2B SaaS marketer, those were a few of my biggest questions.

So I did some research in order to find out for myself.

The results were pretty surprising…

Here are a few highlights…

- 97% of larger SaaS companies advertise with LinkedIn Ads

- 51% of website visitors come from direct traffic

- 58% of the SaaS 100 are spending less than $10,000 per month on Google search ads.

Summary of what’s included in the report:

- My Research Methodology

- SaaS 100 Website Traffic Volume

- SaaS 100 Traffic Sources

- SaaS 100 Social Traffic Sources

- SaaS 100 Paid Advertising Platforms

My Research Methodology

Before I get too far into the data, I want to share with you where the data came from.

To start with, I copied and pasted the Forbes Cloud 100 list of the largest 100 SaaS companies into a spreadsheet.

Next, I went to SimilarWeb to gather data about where these 100 sites were getting their traffic from. The data at SimilarWeb isn’t exact, but it gives us a good sense of where visitors are coming from. Especially on an aggregate level. The data we used was all from the month of October 2019.

Next, I went to SpyFu.com to get SEO and PPC data about the companies. SpyFu gave me data about estimated PPC ad spend, keywords, and search traffic. This data was gathered in November 2019

Lastly, I spied on the social ads of all 100 companies on Facebook, LinkedIn and Twitter. We check their social ads in the middle of November 2019.

Now let’s get into the findings…

SaaS 100 Website Traffic Volume

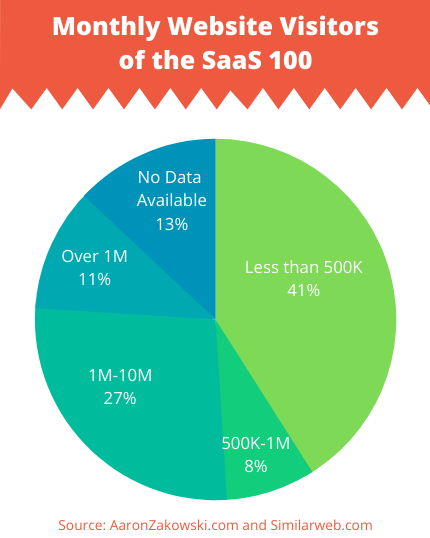

On average, the SaaS 100 got 5,115,000 monthly website visits. However, this number doesn’t really tell the complete story because 41% of the companies had less than 500K monthly visits and large outliers like Canva.com received over 88 million visitors per month!

Put another way, 10 companies received 75% of all the website traffic across all 100 sites.

Wow! How’s that for the 80/20 rule in action

Here’s how the traffic volumes were distributed:

- 41% of companies had less than 500K visitors

- 8% of companies had 500K to 1 million visitors

- 27% of companies had 1M to 10M visitors

- 11% of companies had more than 10M visitors

- 13% of companies didn’t have traffic data available from SimilarWeb

Who’s getting over 10M visitors?

An interesting observation was that the companies with over 10 million monthly visitors were generally focused on SMB customers. Those companies had generally lower revenue per user and therefore relied on a higher volume of customers. Many of them also offer free plans that bring in lots of additional users.

These high traffic companies included names you’re likely to know like, DigitalOcean, Monday.com, Stripe, Cloudflare, Auth0, Squarespace, Mailchimp, Asana, Zoho, AppsFlyer, and Canva.

Many of the other companies are serving more enterprise customers with much higher average customer values so they don’t rely on as many customers to make money.

SaaS 100 Traffic Sources

On average, here is where the largest B2B SaaS companies get their web traffic:

- 52% Direct Traffic

- 32% Search (paid and organic)

- 7% Referral

- 5% Email

- 3% Social (paid and organic)

- 1% Display

At first, I was really surprised that 52% of traffic came from Direct. But then, I realized that the nature of SaaS is that all their customers will frequently visit their sites to use the products.

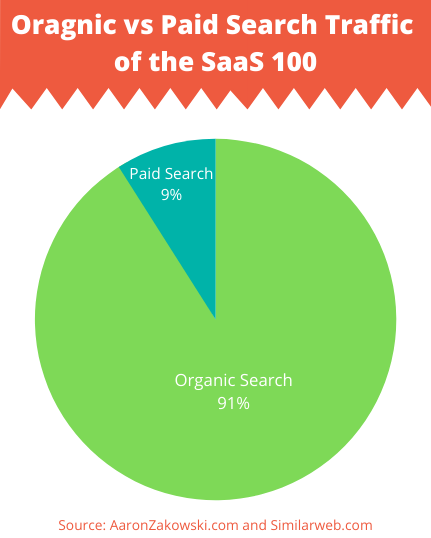

Of the search traffic, the breakout of paid versus organic is as follows:

- 91% Organic Search

- 9% Paid Search

Clearly, these companies are investing heavily in content marketing and SEO.

SaaS 100 Social Traffic Sources

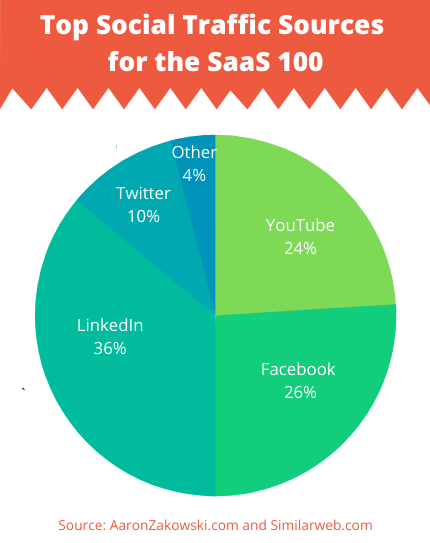

According to SimilarWeb, the companies are receiving an average of 3% of their overall traffic from Social networks.

That traffic breaks down to the different networks as follows (including both paid and organic):

- 36% LinkedIn

- 26% Facebook

- 24% YouTube

- 10% Twitter

- 4% Others

LinkedIn really surprised me here as a major traffic driver for these companies. We generally think of Facebook as the king when it comes to social traffic, but in the B2B space, LinkedIn is a major player.

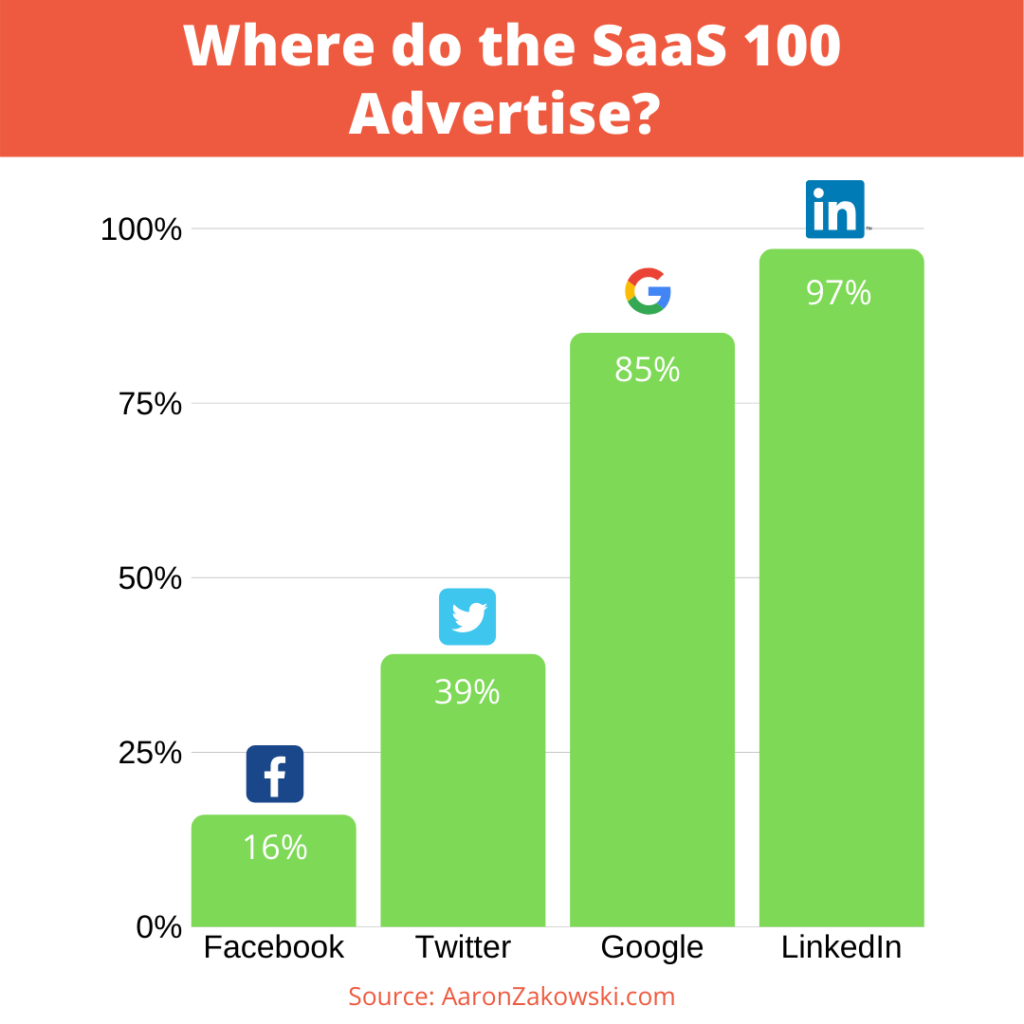

SaaS 100 Paid Advertising Platforms

This is where the data really surprised me!

You don’t hear much talk about LinkedIn Ads in general, but 97% of the SaaS 100 are actively running LinkedIn ads.

Here’s what I discovered:

- 97% of the companies run paid advertising on LinkedIn

- 85% of the companies run paid advertising on Google Search

- 39% of the companies run paid advertising on Twitter

- 10% of the companies run paid advertising on Facebook

Not only was I shocked by how many companies run ads on LinkedIn, but I was also surprised by how few are advertising on Facebook ads. That probably because so many of these companies rely on Enterprise customers and the decision makers that those organizations are most easily identified on LinkedIn.

Unfortunately, there’s no way for us to know how much ad budget these companies are spending on Facebook, LinkedIn or Twitter.

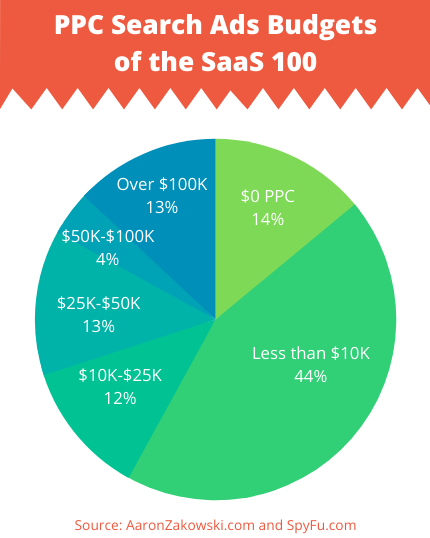

But we do have estimated data on Google Search Ads budgets.

On Average, these companies spend $50K on Search Ads per month.

Here’s what the data segmented by tiers looks like…

- 14% of the companies aren’t spending any budget Google Ads

- 44% of the companies are spending less than $10K on Google Ads

- 12% of the companies are spending $10K to $25K on Google Ads

- 13% of the companies are spending $25K to $50K on Google Ads

- 4% of the companies are spending $50K to $100K on Google Ads

- 13% of the companies are spending over $100K on Google Ads

Looking at the raw data, there’s a strong correlation between higher website traffic and higher PPC budgets. The companies spending more on PPC tend to target a broader customer demographic of Small and Medium businesses (SMBs).

Conclusion

Some of the data here was really eye-opening to me. Especially, how dominant LinkedIn has become for B2B SaaS.

What were your biggest takeaways?

Keep investing in SEO 😉

Great stuff Aaron. Thank you for putting this together. Well done mate.

My 3 takeaways –

1) B2B Enteprises are under utilizing Facebook (and Instagram). There are lessons to be learnt here from hubspot and other inbound focussed companies. In the SMB space, we (www.foyr.com) see highest RoAS for FB/Insta ads.

2) Linkedin indeed is surprising but tha’t in part due to appetite of these companies to spend

3) Content and brand takes over eventually. Performance marketing gives way to brand marketing.